Image Credit: Nvidia

Abstract

Nvidia Corporation stands as a colossus in the semiconductor landscape, its graphics processing units (GPUs) powering the explosive growth of artificial intelligence (AI). Founded in 1993 amid the nascent 3D graphics boom, Nvidia has evolved under CEO Jensen Huang’s visionary leadership into the world’s most valuable company, boasting a market capitalization exceeding $4.5 trillion as of December 2025. This paper chronicles Nvidia’s origins and pivotal decisions that propelled its trajectory, examines the bearish perspectives on AI’s economic implications, and concludes by framing Nvidia’s dual legacy: as the architect of the Fourth Industrial Revolution, fueled by AI-driven innovation, and as an inadvertent catalyst for what may become history’s largest asset bubble. Drawing on financial data, historical analysis, and expert critiques, we highlight the tension between transformative potential and speculative excess.

1. From Denny’s to Dominance: The History of Nvidia and Jensen Huang

1.1 The Immigrant Journey

Jensen Huang was born Jen-Hsun Huang on February 17, 1963, in Tainan, Taiwan. His family moved to Thailand when he was five, where his father worked as a chemical engineer, and his mother helped him and his brother learn English in preparation for life in America (Quartr, 2024; Britannica Money, 2024).

Image Credit: Nvidia

At age nine, Huang and his brother arrived in Tacoma, Washington, to live with relatives who mistakenly enrolled them at the Oneida Baptist Institute in Kentucky, a reform school for troubled youth. The harsh environment taught him resilience; he endured bullying, cleaned toilets daily, and even traded lessons in reading for weightlifting tips (Time Extension, 2024). Huang later credited this period with shaping his determination and work ethic (Faster Than Normal, 2024).

After reuniting with his parents in Oregon, Huang attended Aloha High School, then earned a bachelor’s in Electrical Engineering from Oregon State University in 1984, where he met his future wife, Lori Mills. He later obtained a master’s degree in Electrical Engineering from Stanford University in 1992 while working at AMD and LSI Logic (Nvidia Newsroom, 2025).

1.2 The Founding of Nvidia

According to the Computer History Museum, “In 1993, Huang founded NVIDIA with friends Chris Malachowsky and Curtis Priem, with a vision to bring advanced 3D graphics to the gaming and multimedia markets” (Computer History Museum, 2024). The three engineers met at a Denny’s restaurant on Berryessa Road in East San Jose, ironically, the same chain where Huang had worked as a dishwasher during college. As Quartr reports, they initially called their company NVision until they discovered the name was already taken by a toilet paper manufacturer (Quartr, 2024).

Image Credit: Nvidia

The company was incorporated on April 5, 1993, Huang’s 30th birthday, with just $40,000 in starting capital (Britannica Money, 2024). Nvidia soon secured $20 million in venture capital from Sequoia Capital and Sutter Hill Ventures, enabling development of their first chip. As Huang would later reflect in an interview with CNBC, the three founders “had no idea how” to start a company, and “building Nvidia turned out to have been a million times harder” than expected. He has admitted that they probably would not have done it if they had realized the “pain and suffering” involved (CNBC, 2024).

1.3 Near-Death and Resurrection

Nvidia’s first years nearly ended in disaster. The company’s initial product, the NV1, launched in 1995 with a proprietary architecture that proved incompatible with Microsoft’s emerging DirectX standard. A contract with Sega to develop graphics chips for the Dreamcast console further strained resources when Nvidia’s technology proved inadequate (Tom’s Hardware, 2024).

By 1996, Nvidia was on the brink of bankruptcy. In what Huang describes as one of the most difficult decisions of his career, he went to Sega’s CEO, Shoichiro Irimajiri, admitted that Nvidia had failed to deliver on the contract, and asked to be paid anyway to avoid going out of business. As reported by Benzinga, Irimajiri remarkably agreed, providing $5 million that saved the company. As Huang later recalled, “You can’t discount the kindness of people when you’re starting your company” (Benzinga, 2024).

The Sega money funded development of the RIVA 128, which launched in August 1997 when Nvidia was down to one month of payroll. This desperate situation gave birth to what remains Nvidia’s unofficial company motto: “Our company is thirty days from going out of business” (Acquired Briefing, 2025). The RIVA 128 became Nvidia’s first commercial success, selling over one million units in four months and dramatically altering the company’s trajectory (Tom’s Hardware, 2024).

2. The Strategic Decisions That Built an Empire

2.1 Inventing the GPU (1999)

On October 11, 1999, Nvidia released the GeForce 256, marketing it as “the world’s first GPU.” As the Computer History Museum documents, “One of NVIDIA’s defining moments came in 1999 with the launch of the GeForce 256, the world’s first graphics processing unit, or GPU. This revolutionary integrated circuit combined transform, lighting, and rendering functions to unlock an exponential leap in performance and realism in 3D graphics” (Computer History Museum, 2024). The GeForce 256 offered up to 50% improvement in frame rates over competitors and established Nvidia as a dominant force in gaming graphics (Electronic Design, 2022).

The company went public in January 1999 at a $600 million market capitalization. When the stock price hit $100 per share, Huang celebrated by getting a tattoo of the Nvidia logo on his shoulder (Britannica Money, 2024). By 2000, Nvidia had secured a $500 million annual deal to supply GPUs for Microsoft’s Xbox console, cementing its position in the gaming industry (Acquired Briefing, 2025).

2.2 The CUDA Revolution (2006)

The decision that would ultimately transform Nvidia from a gaming company into an AI powerhouse came in 2006 with the launch of CUDA (Compute Unified Device Architecture). According to TheStreet, “CUDA provides open parallel processing capabilities of GPUs to science and research. It allows software developers to use Nvidia’s GPUs for general-purpose processing” (TheStreet, 2024). This was a radical bet: Nvidia invested hundreds of millions of dollars in software development with no guaranteed market.

Jensen Huang believed that GPUs could enable computational tasks that traditional CPUs could not handle efficiently. As discussed on the Acquired Podcast, “Jensen felt like the GPU platform could enable things that the CPU paradigm could not, and he really had this faith that something would happen” (Acquired Podcast, 2022). For years, this faith seemed misplaced. From 2007 to 2015, the company didn’t grow significantly, and in 2008, Nvidia’s stock dropped 80% as investors questioned the company’s direction (Generative Value, 2024).

The vindication came in 2012 when Alex Krizhevsky’s AlexNet neural network, trained on Nvidia GPUs using CUDA, decisively won the ImageNet competition. As Wing Venture Capital notes, this “heralded the deep learning revolution. GPUs became the engine of AI, which drove rapid progress in neural network performance” (Wing Venture Capital, 2024). Nvidia’s early investment in CUDA created a software ecosystem that became essentially irreplaceable, developers invested thousands of hours learning CUDA, and major AI frameworks like TensorFlow and PyTorch were built on top of it (Medium, 2024).

2.3 The AI Bet Pays Off (2016-Present)

In 2016, Nvidia made another prescient move: donating a DGX-1 supercomputer to the startup OpenAI to work on AI’s “toughest problems” (TheStreet, 2024). This relationship would prove transformational. When OpenAI launched ChatGPT in November 2022, demand for Nvidia’s AI chips exploded. The company’s data center revenue, powered almost entirely by AI, went from $3 billion in fiscal 2020 to over $47 billion in fiscal 2024 (Morningstar, 2024).

Image Credit: Nvidia

As of 2025, according to Jon Peddie Research, Nvidia holds approximately 92% market share in the discrete desktop and laptop GPU market (TechSpot, 2025; Jon Peddie Research via Yahoo Finance, 2025). The company’s market capitalization reached $4 trillion in July 2025, the first company in history to achieve this milestone, having quadrupled from $1 trillion in just two years (CNN, 2025; Al Jazeera, 2025).

3. The Economics of AI: A Bear’s Perspective

3.1 The Circular Financing Problem

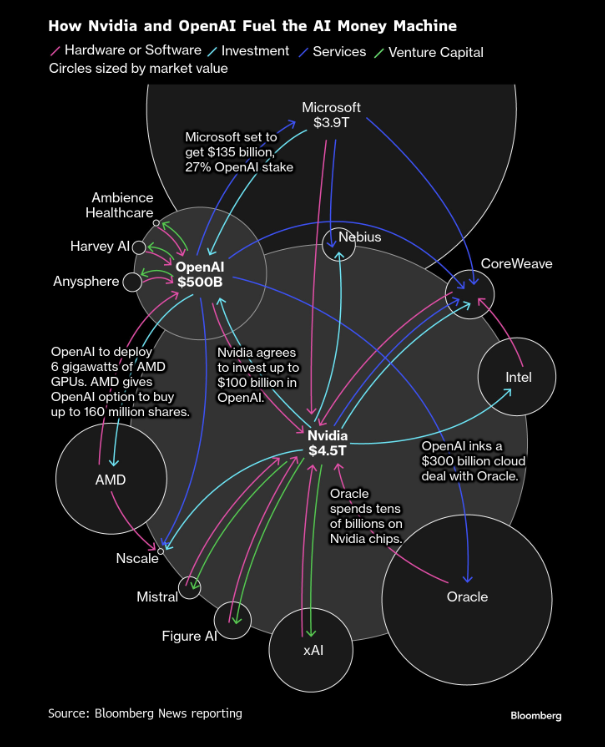

Perhaps no aspect of the current AI boom raises more concerns than the circular financing arrangements that characterize the industry. At the center of this web sits Nvidia, which has invested approximately $53 billion in AI companies between 2020 and 2025 across 170 deals (Yahoo Finance, 2025). The most striking example is Nvidia’s agreement to invest up to $100 billion in OpenAI, an investment that OpenAI will use primarily to purchase Nvidia’s own chips (Fortune, 2025).

As The Register explains, the mechanics work as follows: “Nvidia invests cash into OpenAI, and in exchange OpenAI agrees to spend that money on NVIDIA’s GPU hardware. OpenAI also uses Oracle’s cloud services for its AI workloads, becoming a huge customer for Oracle. Oracle, in turn, uses the revenue from OpenAI to purchase more NVIDIA chips for those data centers” (The Register, 2025). Fortune describes this as “circular financing” that “may give investors an inflated perception of the true demand for AI” (Fortune, 2025).

Michael Burry, the investor famous for predicting the 2008 housing crash, has been vocal about these concerns. According to NPR, Burry has compared Nvidia to Cisco Systems during the dot-com bubble, noting that “true end demand is ridiculously small” and “almost all customers are funded by their dealers” (NPR, 2025). Ainvest reports that Burry has taken significant short positions against Nvidia, deploying $1.1 billion in options against the chipmaker (Ainvest, 2024).

3.2 The ROI Problem

A fundamental question haunts the AI industry: Will the massive investments in AI infrastructure ever generate proportional returns? The evidence is increasingly troubling. According to Entrepreneur, an August 2025 MIT study titled “The GenAI Divide: State of AI in Business 2025” found that despite U.S. businesses investing between $35 billion and $40 billion in AI initiatives, 95% are seeing zero return on investment or no measurable impact on profits (Entrepreneur, 2025).

The math is stark. According to Morningstar, AI infrastructure investments currently require generating $2 trillion in annual revenue by 2030 to justify costs, yet current AI revenues stand at only $20 billion, requiring a 100-fold increase (Morningstar, 2025). Big Tech firms are on track to spend nearly $400 billion on AI infrastructure in 2025 alone, with Amazon leading at $125 billion, followed by Microsoft at $91-93 billion, Google at $75 billion, and Meta at $60-65 billion (SoftwareSeni, 2025).

Nobel Prize-winning economist Daron Acemoglu of MIT has been particularly skeptical. As reported by NPR: “These models are being hyped up, and we’re investing more than we should. I have no doubt that there will be AI technologies that will come out in the next ten years that will add real value and add to productivity, but much of what we hear from the industry now is exaggeration” (NPR, 2025).

3.3 The Cisco Parallel

The comparison between Nvidia today and Cisco Systems during the dot-com bubble has become increasingly common. According to Morningstar, Cisco’s stock “surged more than 1,000 times over the decade” from its 1990 IPO, briefly becoming the world’s most valuable company at $555 billion in March 2000. Then the bubble burst: “More than 20 years later, Cisco has yet to reach that March 2000 peak again” (Morningstar, 2023).

The parallels are notable: Both companies dominated hardware critical to a transformative technology; both benefited from infrastructure buildout funded by speculative investment; and both engaged in vendor financing arrangements. As Elnion reports, “During the late 1990s, CISCO launched extensive vendor-financing schemes that allowed its largest customers to buy equipment they could not fully afford at the time” (Elnion, 2025).

However, defenders argue key differences exist. According to Creative Planning, Nvidia’s price-to-earnings ratio of approximately 50-60x, while elevated, is far below Cisco’s peak of 150x (Creative Planning, 2024). The Motley Fool notes that Nvidia’s margins have expanded rather than contracted (unlike Cisco’s), and the company has demonstrated actual earnings growth to support its valuation rather than pure speculation (Motley Fool, 2024). Yet the structural similarities, concentration risk, circular financing, and infrastructure overcapacity, remain concerning.

3.4 Market Concentration Risk

The concentration of market value in AI-related stocks has reached unprecedented levels. According to Calcalist, as of late 2025, 30% of the U.S. S&P 500 is held by just five companies: Nvidia, Google, Microsoft, Apple, and Amazon, the greatest concentration in half a century (Calcalist, 2025). Morningstar reports that Nvidia alone represents a 7.3% weight on the S&P 500, the largest of any single company (Morningstar, 2025).

According to NPR, the Bank of England has warned of growing risks of a global market correction due to possible overvaluation of leading AI tech firms (NPR, 2025). Remarkably, Sam Altman himself, CEO of OpenAI, acknowledged in 2025 that he believes an AI bubble is ongoing. As reported by Calcalist, Altman stated that investors are “overexcited” about artificial intelligence (Calcalist, 2025).

3.5 The Competitive Threat: Google TPUs and Custom Silicon

Perhaps the most underappreciated risk to Nvidia’s dominance, and ironically, a potential trigger for bubble deflation is the rise of custom silicon from hyperscale cloud providers. Google’s Tensor Processing Units (TPUs) have emerged as the most credible challenger to Nvidia’s GPU monopoly, with performance and cost metrics that could fundamentally disrupt the AI chip market.

According to CNBC, “Some people think TPUs are technically on par or superior to Nvidia’s GPUs,” according to Chris Miller, author of “Chip War” (CNBC, 2025). Independent analysis reveals that Google’s TPU v6 generation achieves 60 to 65 percent better efficiency than comparable Nvidia GPUs (Unified AI Hub, 2025). The economics are compelling: AI News Hub reports that TPUs deliver approximately 4x better performance-per-dollar for inference workloads, which are projected to consume 75% of AI compute by 2030 (AI News Hub, 2025).

The implications became dramatically clear in November 2025 when The Information reported that Meta, one of Nvidia’s largest customers, was in advanced discussions to spend billions of dollars on Google’s TPUs. According to Bloomberg, “A deal would signal growing momentum for Google’s chips and long-term potential to challenge Nvidia’s market dominance” (Bloomberg, 2025). Nvidia’s stock fell 4% on the news while Alphabet’s rose, demonstrating market sensitivity to competitive threats (CNBC, 2025).

The list of companies migrating to or considering TPUs is growing. Anthropic signed what SemiAnalysis describes as “the largest TPU deal in Google history,” committing to up to one million TPUs (SemiAnalysis, 2025). Midjourney, a major AI image generator, switched from Nvidia GPUs to TPUs in 2024 and slashed monthly inference costs from $2.1 million to under $700,000, a 65% reduction (AI News Hub, 2025). According to TechCrunch, Amazon’s Trainium chips have become “a multibillion-dollar revenue run-rate business” with over one million chips in production, offering 30% to 40% cost savings versus Nvidia (TechCrunch, 2025).

The competitive threat extends beyond Google. Amazon announced Trainium3 in December 2025, claiming 50% cost reductions compared to GPU-based training (Yahoo Finance, 2025). Microsoft’s CTO Kevin Scott told CNBC that the company aims to use its homegrown Maia chips “for the majority of its datacenter workloads” (The Register, 2025). As CNBC reports, Daniel Newman of the Futurum Group predicts that custom ASICs are “growing even faster than the GPU market over the next few years” (CNBC, 2025).

This competitive dynamic creates a paradox that could accelerate bubble dynamics. If Nvidia maintains market share, its extraordinary profits depend on customers who may never generate returns on their AI investments. If competitors succeed in eroding Nvidia’s dominance, the company’s current valuation becomes unjustifiable. As AlphaMatch AI notes, “Analysts warn that if Google’s cost advantage forces Nvidia into a price war, it could crater the stock even if they maintain volume” (AlphaMatch AI, 2025). Either scenario, continued circular financing with no end-user returns, or margin compression from real competition, suggests Nvidia’s current valuation is precarious.

Conclusion

Jensen Huang’s journey from a reform school in rural Kentucky to the helm of a multi-trillion-dollar chip company is a testament to resilience and long-term vision. By betting the firm on accelerated computing and the CUDA platform decades before the market understood their value, Nvidia has helped architect the infrastructure for what many now call the Fourth Industrial Revolution.

Yet the company now stands at a precarious peak, caught between two intertwined threats: a financial bubble fueled by circular “round-tripping” of capital and revenue, and a competitive revolt led by its own largest customers. The rise of Google’s TPUs, Amazon’s Trainium, Microsoft’s Maia and other custom accelerators suggests that the market is moving toward a world where AI compute becomes a commoditized utility rather than a scarce luxury good.

Critically, it is important to distinguish between a collapse in Nvidia’s stock price and a collapse of the AI economy itself. A sharp correction in Nvidia’s valuation would almost certainly trigger stress across GPU-cloud providers and AI start-ups that depend on its vendor financing and on abundant, subsidized compute. But such a correction would more likely mark the maturation, rather than the death, of the sector. Just as the crash of railroad equities in the nineteenth century did not end the usefulness of rail transport, a decline in Nvidia’s margins due to competition would primarily mean that the cost of “machine intelligence” is falling.

If the emerging “hyperscaler revolt” succeeds, it will weaken Nvidia’s quasi-monopoly position, but it may simultaneously accelerate the diffusion of AI by making large-scale models affordable to a far broader set of firms and institutions. Nvidia therefore faces a paradox: it has built the engine of the future, yet the full success of that future may depend on the engine becoming cheaper than Nvidia can comfortably sell it. Whether the company remains the singular titan of this era or instead becomes the Cisco of the 2020s, a legendary infrastructure builder that never again regains its peak valuation will go a long way in determining whether the current AI boom is remembered as a justified repricing of a new general-purpose technology or as the defining bubble of this decade.

References

Acquired Briefing. (2025). NVIDIA I (1993-2006). Retrieved from https://www.acquiredbriefing.com/p/nvidia-i

Acquired Podcast. (2022). Nvidia Part II: The Machine Learning Company (2006-2022). Retrieved from https://www.acquired.fm/episodes/nvidia-the-machine-learning-company-2006-2022

Ainvest. (2024). Michael Burry’s Nvidia Bear Case: Valuation Risks and Fraud Allegations. Retrieved from https://www.ainvest.com/news/michael-burry-nvidia-bear-case-valuation-risks-fraud-allegations-ai-chip-market-2511/

AI News Hub. (2025). AI Inference Costs 2025: Why Google TPUs Beat Nvidia GPUs by 4x. Retrieved from https://www.ainewshub.org/post/ai-inference-costs-tpu-vs-gpu-2025

Al Jazeera. (2025, July 9). Nvidia becomes first US company to reach $4 trillion market cap. Retrieved from https://www.aljazeera.com/economy/2025/7/9/nvidia-becomes-first-us-company-to-reach-4-trillion-market-cap

AlphaMatch AI. (2025). Google’s TPU Revolution: The $13 Billion Challenge to Nvidia’s AI Chip Dominance. Retrieved from https://www.alphamatch.ai/blog/google-tpu-nvidia-ai-chip-competition-2025

Benzinga. (2024, May 20). Nvidia’s $2 Trillion Success Story: How An Act Of Kindness From A Top Sega Executive Saved The Jensen Huang-Led Company. Retrieved from https://www.benzinga.com/markets/equities/24/05/38911606/nvidias-2-trillion-success-story

Bloomberg. (2025, November 25). Alphabet Gains on Report That Meta Will Use Its AI Chips. Retrieved from https://www.bloomberg.com/news/articles/2025-11-25/alphabet-gains-on-report-that-meta-will-use-its-ai-chips

Britannica Money. (2024). Jensen Huang | Biography, NVIDIA, Huang’s Law, & Facts. Retrieved from https://www.britannica.com/money/Jensen-Huang

Calcalist. (2025). The circular economy of AI: How big tech is financing itself. Retrieved from https://www.calcalistech.com/ctechnews/article/z4lxiqbtw

CNBC. (2024, May 11). Jensen Huang: I didn’t know how to start a business when launching Nvidia. Retrieved from https://www.cnbc.com/2024/05/11/jensen-huang-i-didnt-know-how-to-start-a-business-when-launching-nvidia.html

CNBC. (2025, November 21). Nvidia sales are ‘off the charts,’ but Google, Amazon and others now make their own custom AI chips. Retrieved from https://www.cnbc.com/2025/11/21/nvidia-gpus-google-tpus-aws-trainium-comparing-the-top-ai-chips.html

CNBC. (2025, November 25). Nvidia stock falls 4% on report Meta will use Google AI chips. Retrieved from https://www.cnbc.com/2025/11/25/nvidia-shares-today-google-meta-ai-chip-report.html

CNN. (2025, July 9). Nvidia beats Apple and Microsoft to become the world’s first $4 trillion public company. Retrieved from https://www.cnn.com/2025/07/09/investing/nvidia-is-the-first-usd4-trillion-company

Computer History Museum. (2024). Jensen Huang. Retrieved from https://computerhistory.org/profile/jensen-huang/

Creative Planning. (2024). From Cisco to Nvidia: Lessons From Past Tech Bubbles. Retrieved from https://creativeplanning.com/insights/investment/cisco-nvidia-lessons-from-past/

Electronic Design. (2022, January 13). Nvidia’s GeForce 256: The First Fully Integrated GPU. Retrieved from https://www.electronicdesign.com/technologies/embedded/article/21178111/jon-peddie-research-nvidias-geforce-256-the-first-fully-integrated-gpu

Elnion. (2025, October 5). NVIDIA’s $100 Billion OpenAI Bet: The Risks of Circular Investment in AI Infrastructure. Retrieved from https://elnion.com/2025/10/05/nvidias-100-billion-openai-bet-the-risks-of-circular-investment-in-ai-infrastructure/

Entrepreneur. (2025, August 20). Nearly 95% of Companies Saw Zero Return on In-House AI Investments, According to a New MIT Study. Retrieved from https://www.entrepreneur.com/business-news/most-companies-saw-zero-return-on-ai-investments-study/496144

Faster Than Normal. (2024). Jensen Huang. Retrieved from https://www.fasterthannormal.co/people/jensen-huang

Fortune. (2025, September 28). Nvidia’s $100 billion investment in OpenAI has analysts asking about ‘circular financing’ inflating an AI bubble. Retrieved from https://fortune.com/2025/09/28/nvidia-openai-circular-financing-ai-bubble/

Generative Value. (2024). Nvidia: Past, Present, and Future. Retrieved from https://www.generativevalue.com/p/nvidia-past-present-and-future

Jon Peddie Research. (2025). GPU Market Share Q1 2025. As reported in Yahoo Finance: Nvidia Secures 92% GPU Market Share in Q1 2025. Retrieved from https://finance.yahoo.com/news/nvidia-secures-92-gpu-market-150444612.html

Morningstar. (2023, December). Nvidia Stock 2023 vs Cisco Stock 1999: Will History Repeat Itself? Retrieved from https://www.morningstar.com/stocks/nvidia-2023-vs-cisco-1999-will-history-repeat

Morningstar. (2025). Why the AI Spending Spree Could Spell Trouble for Investors. Retrieved from https://www.morningstar.com/markets/why-ai-spending-spree-could-spell-trouble-investors

Motley Fool. (2024, June 25). Why Nvidia Stock Is Not Like Cisco Before the Dot-Com Bubble Burst. Retrieved from https://www.fool.com/investing/2024/06/25/nvda-stock-fall-cisco-dot-com-bubble-burst/

NPR. (2025, November 23). Here’s why concerns about an AI bubble are bigger than ever. Retrieved from https://www.npr.org/2025/11/23/nx-s1-5615410/ai-bubble-nvidia-openai-revenue-bust-data-centers

Nvidia Blog. (2025). Jensen Huang Author Page. Retrieved from https://blogs.nvidia.com/blog/author/jen-hsun-huang/

Nvidia Newsroom. (2025). Jensen Huang Biography. Retrieved from https://nvidianews.nvidia.com/bios/jensen-huang

Quartr. (2024). The Story of Jensen Huang and Nvidia. Retrieved from https://quartr.com/insights/edge/the-story-of-jensen-huang-and-nvidia

Research Affiliates. (2025). The AI Boom vs. the Dot-Com Bubble: Have We Seen This Movie Before? Retrieved from https://www.researchaffiliates.com/publications/articles/1038-ai-boom-dot-com-bubble-seen-this-before

SemiAnalysis. (2025). Google TPUv7: The 900lb Gorilla In the Room. Retrieved from https://newsletter.semianalysis.com/p/tpuv7-google-takes-a-swing-at-the

SoftwareSeni. (2025). How Big Tech Companies Are Spending Over 250 Billion Dollars on AI Infrastructure. Retrieved from https://www.softwareseni.com/how-big-tech-companies-are-spending-over-250-billion-dollars-on-artificial-intelligence-infrastructure-and-what-this-means-for-return-on-investment/

TechSpot. (2025). Nvidia reaches historic 92% GPU market share, leaves AMD and Intel far behind. Retrieved from https://www.techspot.com/news/108225-nvidia-reaches-historic-92-gpu-market-share-leaves.html

TechCrunch. (2025, December 3). Andy Jassy says Amazon’s Nvidia competitor chip is already a multibillion-dollar business. Retrieved from https://techcrunch.com/2025/12/03/andy-jassy-says-amazons-nvidia-competitor-chip-is-already-a-multi-billion-dollar-business/

The Register. (2025, November 4). AI’s trillion dollar deal wheel bubbling around Nvidia, OpenAI. Retrieved from https://www.theregister.com/2025/11/04/the_circular_economy_of_ai/

The Register. (2025, October 2). Microsoft aims to swap AMD, Nvidia GPUs for its own AI chips. Retrieved from https://www.theregister.com/2025/10/02/microsoft_maia_dc/

TheStreet. (2024). History of Nvidia: Company timeline and facts. Retrieved from https://www.thestreet.com/technology/nvidia-company-history-timeline

Time Extension. (2024). How The Kindness Of Sega Saved Nvidia From Going Under. Retrieved from https://www.timeextension.com/features/flashback-how-the-kindness-of-sega-saved-nvidia-from-going-under

Tom’s Hardware. (2024). Nvidia nearly went out of business in 1996 trying to make Sega’s Dreamcast GPU. Retrieved from https://www.tomshardware.com/tech-industry/nvidia-nearly-went-out-of-business-in-1996-trying-to-make-segas-dreamcast-gpu-instead-sega-americas-ceo-offered-the-company-a-dollar5-million-lifeline

Wing Venture Capital. (2024). The major computing cycles: From IBM to NVIDIA, CUDA and the generative AI age. Retrieved from https://www.wing.vc/content/major-computing-cycles-ibm-nvidia-cuda-generative-ai

Yahoo Finance. (2025). Nvidia’s $24B AI deal blitz has Wall Street asking questions about ‘murky’ circular investments. Retrieved from https://finance.yahoo.com/news/nvidias-24b-ai-deal-blitz-has-wall-street-asking-questions-about-murky-circular-investments-110039309.html

Yahoo Finance. (2025, December 2). Amazon releases new AI chip amid industry push to challenge Nvidia’s dominance. Retrieved from https://finance.yahoo.com/news/amazon-releases-new-ai-chip-amid-industry-push-to-challenge-nvidias-dominance-160720223.html

Unified AI Hub. (2025). Google TPUs Reshape AI Hardware Landscape — A Real Rival to Nvidia in 2025. Retrieved from https://www.unifiedaihub.com/ai-news/googles-tpus-reshaping-ai-hardware-landscape-challenge-to-nvidia