Photo Credit: Michael Barera

Introduction

Over the past decade, the Dallas – Fort Worth (DFW) metropolitan area has emerged as one of the most dynamic business regions in the United States. In addition to steady population and employment growth, the region has become a magnet for corporate headquarters relocations, particularly from higher-cost coastal markets. A recent update from CBRE reports that between 2018 and 2024 the DFW metro attracted 100 new corporate headquarters, the highest number of any U.S. metropolitan area during that period (CBRE Americas Consulting, 2025; Egan, 2025). This wave of relocations has strengthened the perception of Dallas as a central node in the national business and financial landscape.

Dallas’s current role as a headquarters and advanced-services hub is not accidental; it reflects a long historical evolution of the city’s economy. Since the mid-19th century, Dallas has transitioned from a river trading post to a rail crossroads, then to a regional wholesale and financial center, a manufacturing and technology hub, and finally to a globally connected service and logistics platform anchored by major transportation and financial assets such as the Dallas – Fort Worth International Airport and a branch of the Federal Reserve Bank (McElhaney & Hazel, 2025). This path-dependent development created the transportation infrastructure, institutional capacity, and business networks that modern corporations leverage when they relocate to the region.

At the same time, Dallas policymakers have been actively refining their economic development strategies. The City of Dallas adopted an Economic Development Policy and a companion Economic Development Incentive Policy that use tax abatements, grants, and loans to attract and retain firms while emphasizing equitable participation in the local economy (City of Dallas Office of Economic Development, 2021, 2022). These policies are designed to grow the tax base, create living-wage jobs, and direct investment to historically under-resourced neighborhoods.

This research examines how corporate headquarters relocations have affected the economic development of the Dallas–Fort Worth region and assesses the role of local incentives and the broader business climate in driving these moves. The central research question is: How have headquarters relocations to the DFW region since 2010 influenced employment growth, industry composition, and the tax base, and what role have local incentives and the business environment played in attracting these relocations? The working thesis is that relocations have reinforced DFW’s strengths in business and financial services, professional services, and technology, contributing to job growth and a broader tax base, but that the long-term benefits depend on how effectively Dallas targets incentives and invests in inclusive development.

Courtesy of Goldman Sachs

Literature Review and Theoretical Framework

Research on headquarters relocation and firm location decisions identifies several recurring drivers: cost structures (especially taxes and labor), access to skilled talent, quality of life, the business climate, and broader strategic considerations. Studies in regional economics emphasize that firms do not choose locations randomly; instead, they respond to both external drivers, such as taxes, regulation, and infrastructure, and internal factors such as corporate strategy and existing footprints.

Gregory et al. (2005) examine the impact of headquarters relocation on firm performance and find that market reactions and subsequent operating outcomes depend on the motivation for relocation, including cost reduction and strategic repositioning. Their results suggest that relocations can be value-creating for firms but do not automatically maximize benefits for host communities. More recent work connects headquarters relocations to broader regional outcomes. Hu et al. (2025), for example, show that corporate relocations can raise local housing price growth in receiving areas, producing both temporal and spatial spillover effects and highlighting how corporate moves can reshape local real estate markets and affordability.

A second strand of literature focuses on agglomeration economies, the productivity and innovation benefits that firms realize when they locate near other firms, skilled workers, and specialized suppliers. Bolter and Robey (2020) review evidence that denser labor markets and industry clusters are associated with higher productivity, particularly in knowledge-intensive sectors. In this framework, headquarters relocations both respond to existing clusters and deepen them, as additional firms concentrate in regions with strong talent pools, infrastructure, and business services.

The role of incentives is more contested. Economic development practitioners often use tax abatements and grants to attract headquarters, but empirical work and practitioner reports suggest that incentives are typically secondary to fundamentals such as workforce and accessibility (CBRE Americas Consulting, 2025; Federal Reserve Bank of Dallas, 2024). Critics argue that poorly designed incentives can erode the tax base and create windfalls for firms that would have relocated regardless, especially when transparency and performance metrics are weak.

This paper applies two main analytical frameworks. First, PESTEL analysis is used to evaluate the political, economic, social, technological, environmental, and legal factors that shape Dallas’s attractiveness for headquarters relocation. Second, agglomeration and cluster theory is used to examine how relocations interact with existing industry clusters, particularly in business and financial services and professional services, and how these clusters contribute to regional development (Bolter & Robey, 2020; Federal Reserve Bank of Dallas, 2017; Pranger & Su, 2023). Together, these frameworks connect firm-level location choices to regional growth patterns and policy choices.

Economic Context of the Dallas–Fort Worth Region

The modern prominence of Dallas–Fort Worth as a headquarters and services hub rests on more than a century of economic development. Historically, Dallas evolved from a Trinity River trading post into a major rail crossroads and wholesale center for cotton and other commodities in the late 19th century, before broadening into finance, manufacturing, and later technology and aviation (McElhaney & Hazel, 2025). The establishment of a Federal Reserve Bank branch in 1914 and the development of Dallas–Fort Worth International Airport in the 1970s cemented the region’s role as a financial and transportation hub (McElhaney & Hazel, 2025). These milestones created durable advantages in logistics, finance, and connectivity that underpin today’s corporate landscape.

Contemporary labor-market data confirm the strength of the regional economy. Bureau of Labor Statistics (BLS) figures show that total nonfarm employment in the Dallas–Fort Worth–Arlington metro increased by 58,700 jobs over the year to August 2024 and by 46,800 jobs over the year to May 2025, corresponding to annual growth rates of roughly 1.4 percent and 1.1 percent, respectively (Bureau of Labor Statistics [BLS], 2024, 2025a). The broader labor force exceeds 4.5 million workers, and the unemployment rate has remained in the mid-single digits (BLS, 2025b). These figures indicate solid, though moderating, growth that aligns with statewide trends of a cooling but still expanding Texas economy (Federal Reserve Bank of Dallas, 2025).

Source: U.S. Bureau of Labor Statistics.

In terms of sectors, DFW has a diversified economy anchored by business and financial services, professional services, information technology, transportation and logistics, and healthcare. The Federal Reserve Bank of Dallas’s report, “At the Heart of Texas: Dallas–Plano–Irving,” highlights the importance of the business and financial services cluster, which expanded its share of regional employment in the early 2010s (Federal Reserve Bank of Dallas, 2017). Consolidations and relocations by firms, such as large insurers and financial institutions, to campuses in the northern suburbs brought thousands of jobs and helped make insurance and professional services some of the metro’s fastest-growing industries. Pranger and Su (2023) find that professional services jobs have grown faster in Texas than in the United States overall since 2020 and that this growth has been heavily concentrated in a small number of counties with large, highly educated workforces, many of which are within the DFW region.

From a PESTEL perspective, several factors strengthen Dallas’s value proposition for corporate headquarters. Politically and legally, Texas offers a relatively predictable, pro-business regulatory environment and no state personal income tax. Municipalities like Dallas have authority under state law to use local tax abatements and grants to pursue economic development (City of Dallas Office of Economic Development, 2021, 2022; Federal Reserve Bank of Dallas, 2024). Economically, DFW’s large and growing labor market, central U.S. location, two major airports, and diversified industry base make it attractive for national and global operations. Socially, net in-migration from higher-cost regions has expanded the skilled workforce, even as rising housing costs introduce new equity and affordability challenges (Federal Reserve Bank of Dallas, 2025; Hu et al., 2025). Technologically, growth in data centers, telecom, and digital infrastructure builds on the city’s longstanding electronics and technology presence, further enabling digital-intensive headquarters functions.

Headquarters Relocations and Incentive Policy

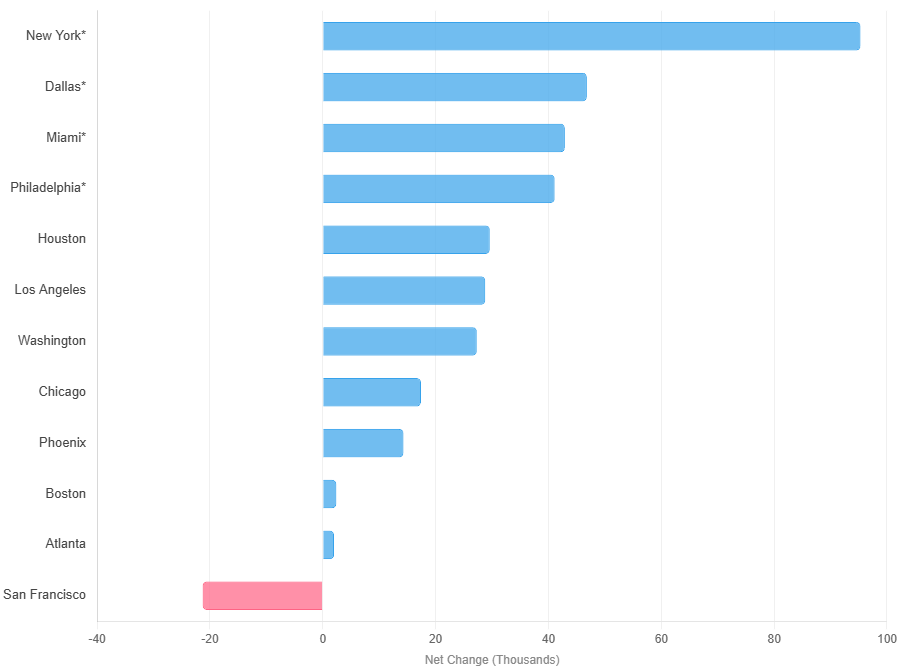

Within this economic context, corporate headquarters relocations provide a visible indicator of how firms are responding to Dallas–Fort Worth’s competitive advantages. CBRE’s 2025 update on headquarters relocations ranks DFW as the leading U.S. metro between 2018 and 2024, with 100 HQ relocations, more than Austin, Nashville, Houston, Phoenix, or Denver (CBRE Americas Consulting, 2025; Egan, 2025). Many of these relocations involve large firms in finance, insurance, technology, and professional services.

Courtesy: Toyota

While some high-profile moves, such as Toyota North America’s decision to locate in Plano, have occurred outside the formal City of Dallas limits, they nevertheless contribute to the broader regional economy and labor market. The clustering of headquarters and major campuses in the northern part of the metro has reinforced a northward tilt in high-wage job growth, even as the City of Dallas seeks to channel more investment into historically under-invested southern neighborhoods (City of Dallas Office of Economic Development, 2021; Federal Reserve Bank of Dallas, 2017). From a cluster perspective, these relocations deepen DFW’s business and financial services and professional services hubs. The Dallas Fed notes that Texas counties with large, highly educated workforces have captured a disproportionate share of new professional services jobs, and relocations are an important part of that story (Pranger & Su, 2023; Federal Reserve Bank of Dallas, 2024). Agglomeration theory suggests that as these clusters thicken, they become even more attractive to additional firms, creating a virtuous cycle of talent and investment (Bolter & Robey, 2020).

Headquarters relocations affect regional economic development through several channels. Directly, they can bring hundreds or thousands of high-wage jobs in management, finance, IT, and professional services. Indirectly, they increase local demand for legal, accounting, consulting, marketing, real estate, and hospitality services, benefitting local business ecosystems. Over time, successful relocations can expand the property and sales tax base, although the net fiscal effect depends on the size and structure of any incentives and on where within the metro the investments occur. At the same time, higher-income workers increase demand for housing and amenities, potentially contributing to rising housing costs and congestion; Hu et al. (2025) find that corporate relocations are associated with faster housing price growth in receiving areas.

Given the scale of recent and ongoing relocations, the design of Dallas’s incentive framework plays a critical role in shaping which projects move forward, where they locate, and how their benefits are distributed. The City’s Economic Development Policy serves as a strategic guide, emphasizing equitable growth and the need to address disparities in opportunities and outcomes for historically disadvantaged communities (City of Dallas Office of Economic Development, 2021). The Economic Development Incentive Policy specifies the types of incentives available, eligibility criteria, and performance expectations (City of Dallas Office of Economic Development, 2022).

Key tools include as-of-right tax abatements for projects that meet minimum job-creation and investment thresholds; negotiated business development incentives, such as supplemental abatements, grants, or loans tied to job creation, wages, and local hiring; and community development programs aimed at small businesses and projects in target areas. These programs operate within a statewide framework in which Texas is a national leader in firm relocations, but the Dallas Fed emphasizes that fundamentals such as workforce and infrastructure remain the primary drivers of location decisions (Federal Reserve Bank of Dallas, 2024).

Discussion and Conclusion

Synthesizing the historical evolution, economic context, relocation trends, and incentive framework provides a holistic view of Dallas Fort Worth’s development trajectory. The evidence suggests that headquarters relocations have been an important, though not exclusive, contributor to regional economic growth. The region’s core advantages in logistics, finance, talent, and connectivity, built up over decades, create the conditions under which firms choose to relocate. Relocations, in turn, reinforce and accelerate the development of high-value clusters in business and financial services and professional services (Federal Reserve Bank of Dallas, 2017, 2024; Pranger & Su, 2023).

However, the distribution of benefits from relocations is uneven. Many major campuses are located outside the City of Dallas proper, and high-wage growth has been concentrated in northern suburbs, while parts of southern Dallas and other historically under-invested areas continue to face limited access to high-quality jobs and amenities (City of Dallas Office of Economic Development, 2021). At the same time, relocations contribute to housing and infrastructure pressures, especially in high-demand submarkets, which can exacerbate affordability challenges (Hu et al., 2025).

From a policy perspective, three priorities stand out. First, Dallas should continue to target incentives toward projects that both deepen competitive clusters and commit to inclusive growth through local hiring, workforce development partnerships, and supplier diversity. Second, strengthening transparency and performance metrics for incentive deals, including clear reporting and clawback provisions, can help ensure that public resources generate meaningful incremental benefits. Third, pairing incentives with investments in talent pipelines, transit, and housing can help more residents access the opportunities created by relocations and mitigate negative side effects.

In conclusion, Dallas – Fort Worth has successfully leveraged its historical strengths and contemporary advantages to position itself as the nation’s leading destination for corporate headquarters relocations (CBRE Americas Consulting, 2025; Egan, 2025). When combined with thoughtful policy design and investment, these relocations can serve as a powerful lever for regional economic development. The challenge for policymakers is to maintain the region’s competitiveness while ensuring that the gains from growth are broadly shared and fiscally sustainable.

References

Bolter, K., & Robey, J. (2020). Agglomeration economies: A literature review. W.E. Upjohn Institute for Employment Research. https://research.upjohn.org/reports/252/

Bureau of Labor Statistics. (2024, October 2). Dallas–Fort Worth area employment — August 2024. U.S. Department of Labor. https://www.bls.gov/regions/southwest/news-release/areaemployment_dallasfortworth.htm

Bureau of Labor Statistics. (2025a, July 2). Dallas–Fort Worth area employment — May 2025. U.S. Department of Labor. https://www.bls.gov/regions/southwest/news-release/areaemployment_dallasfortworth.htm

Bureau of Labor Statistics. (2025b). Dallas–Fort Worth–Arlington, TX economy at a glance. U.S. Department of Labor. https://www.bls.gov/eag/eag.tx_dallas_msa.htm

CBRE Americas Consulting. (2025, May 7). The shifting landscape of headquarters relocations: 2025 update. CBRE. https://www.cbre.com/insights/viewpoints/the-shifting-landscape-of-headquarters-relocations-2025-update

City of Dallas Office of Economic Development. (2021). Economic development policy [Policy document]. City of Dallas. https://dallascityhall.com/departments/economic-development/DCH%20Documents/CITY%20OF%20DALLAS%20ECONOMIC%20DEVELOPMENT%20POLICY.pdf

City of Dallas Office of Economic Development. (2022). City of Dallas economic development incentive policy (Effective January 1, 2023–December 31, 2024). City of Dallas. https://dallascityhall.com/departments/economic-development/DCH%20Documents/Exhibit%20B_Incentive%20Policy_11072022.pdf

Egan, J. (2025, June 20). Dallas ranks No. 1 city in U.S. for corporate HQ relocations. CultureMap Dallas. https://dallas.culturemap.com/news/innovation/corporate-headquarters-relocations-dfw

Federal Reserve Bank of Dallas. (2017). At the heart of Texas: Dallas–Plano–Irving. Federal Reserve Bank of Dallas. https://www.dallasfed.org/research/heart/dallas

Federal Reserve Bank of Dallas. (2024, February 2). Hang your hat in Texas: State remains a leader in firm relocations. Southwest Economy, 2024(2). https://www.dallasfed.org/research/swe/2024/swe2402

Federal Reserve Bank of Dallas. (2025, December 4). Texas economic indicators: November 2025. Dallas Fed Economics. https://www.dallasfed.org/research/texas

Gregory, R., Lombard, J. R., & Seifert, B. (2005). Impact of headquarters relocation on the operating performance of the firm. Economic Development Quarterly, 19(3), 260–270. https://doi.org/10.1177/0891242405276360

Hu, M. R., Tsang, D., & Wan, W. X. (2025). Corporate relocation and housing market spillovers. Management Science, 71(5), 4344–4376. https://doi.org/10.1287/mnsc.2021.01819

McElhaney, J., & Hazel, M. V. (2025, May 31). Dallas, TX. In Handbook of Texas Online. Texas State Historical Association. https://www.tshaonline.org/handbook/entries/dallas-tx

Pranger, A., & Su, Y. (2023, May 16). Recent growth of professional services jobs favors select Texas counties. Dallas Fed Economics. https://www.dallasfed.org/research/economics/2023/0516